The quick rose of the modern labor market is very evident. Permanent jobs are still abundant but we witness more and more people swapping traditional employment modes for a new type – freelance, short-term, and independent contracting. To be successful in such an environment, both employers and employees should have a clear vision of the contract, work, rights, and responsibilities that largely determine these interactions. A lack of clarity might lead to misunderstandings, for example, it may not be clear what payment is due or what the obligations are or even the definition of services that are being provided.

This article deals with the basic aspects of contract work, the reasons for the importance of clarity, the responsibilities of each side, and the impact of the legal environment on employment contracts today.

What Is Contract Work?

Contract work can be termed as an understanding between an employee and an employer, or a client and a worker, in which written or spoken communication is used. For example, permanent employees have less power in their hands in contrast to independent contractors, who are more autonomous since they focus on contract-based jobs.

Contract workers can also discuss their contracts with the following professionals:

- Freelancers offering creative, IT, or consulting services.

- Independent contractors hired for construction, legal, or technical roles.

- Project-based employees engaged through agencies or direct arrangements.

The key characteristic is the agreement itself: it is the trusted document that details the obligations, expectations, and rights to be covered by the worker and client.

Why Understanding Contract Terms Matters

Contracts serve the defense shield on both sides. The worker, on the one hand, is guaranteed the minimum salary and protection from exploitation, while the employer, on the other hand, is confident that the contractor will accomplish the tasks as agreed. However, not following the terms correctly can generate conflicts, lawsuits or money problems.

For instance:

- A freelance designer expects full payment on delivery, while the employer assumed installment payments.

- An independent consultant believes they own the intellectual property, but the contract assigns it to the employer.

Such situations show how a lack of knowledge in understanding employment agreements can lead to trouble before making one such agreement.

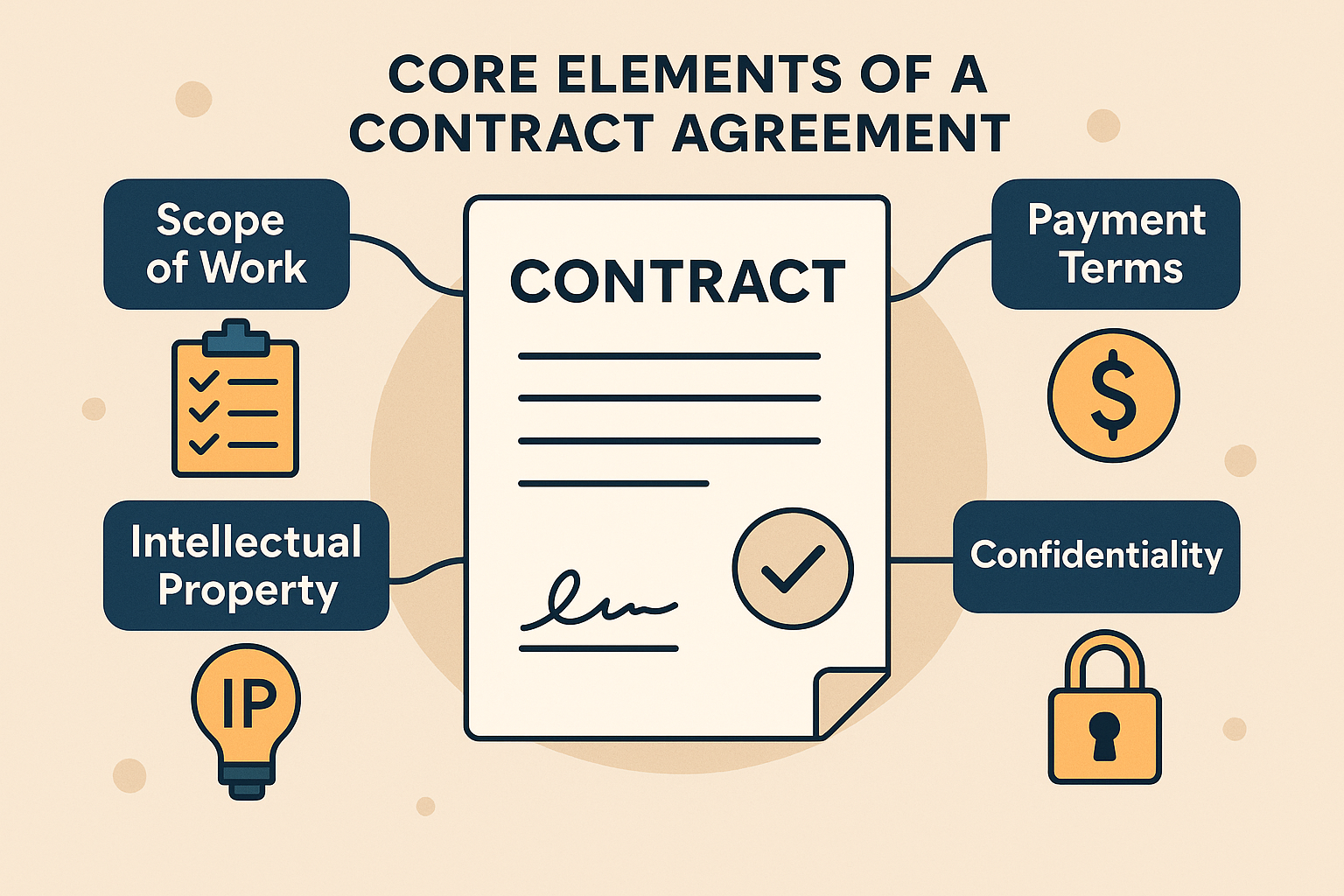

Core Elements of a Contract Agreement

Every employment contract, regardless of it being for permanent staff or a freelance contractor, should contain fundamental clauses. The summary included below showcases the key aspects of any agreement.

| Clause | Purpose | Typical Issues Without It |

| Scope of Work | Defines the exact services or deliverables. | Disputes over what tasks are included. |

| Payment Terms | Amount, schedule, and method of payment. | Late payments, underpayment, or unpaid invoices. |

| Duration & Termination | How long the agreement lasts and conditions for ending it. | Unexpected termination or indefinite work. |

| Confidentiality | Protects sensitive company data or personal information. | Data breaches, IP misuse, or legal exposure. |

| Intellectual Property | Clarifies ownership of work created during the contract. | Both sides claiming rights over creative/technical output. |

| Dispute Resolution | Outlines how conflicts will be settled (e.g., arbitration, court). | Lengthy and costly legal battles. |

With common mutual understanding of these terms by both the employer and the employee (or independent contractor), the relationship becomes more equitable and constructive.

Rights of Contract Workers

Rights are different in every country and jurisdiction, yet a few principles are broadly applicable among them:

- Right to Fair Pay – Workers must be given the entire amount agreed for the services they have rendered, no matter if the employer’s business has been a success or not.

- Right to Safe Working Conditions – Even in the case of independent contractors, a safe environment when working on client’s premises is expected.

- Right to Intellectual Credit – Except when assigned to the company, freelance creators retain their own IPRs.

- Right to Termination Notice – A number of legal frameworks state that, in the event of a change to the contract, notice periods must be included.

- Right to Non-Discrimination – Contract workers are entitled to protection against discrimination based on legally recognized categories.

Responsibilities of Contract Workers

Besides rights, responsibilities are also significant ones. Agreement holders are deemed to:

- Offer the finished services in a timely and quality manner as part of the agreement.

- Uphold secrecy if any and deter conflict of interest.

- Follow the set timelines, be professional, and communicate properly.

- Contribute to the local tax revenue (independent contractors mostly manage their own taxes).

- Accept to provide their own tools, equipment, or insurance unless something else is mentioned.

By not living up to these obligations, the employer can find the reasons to terminate the contract or to withhold the payment.

Employer Obligations Towards Contractors

The obligations of the employer, from their side, involve:

- Offering concise and just contracts before starting work.

- Making timely payments and following the stipulations of the contract.

- Giving freelance professionals their independence and not treating them as employees if they are recognized by law as contractors.

- Providing the contractor with a secure work environment if the on-site worker is contracted in.

- Observing confidentiality of the agreements, as well as the contractor’s work.

A misplaced line between “employee” and “independent contractor” can entail financial penalties, tax violations, and labor law issues for the employer.

Freelance and Independent Work: A Growing Trend

Freelance and independent employment is a global phenomenon which has been expanding owing to the rapid growth of digital platforms and remote technology. Reports from the latest studies indicate that over 30% of professionals in rich economies take part in different kinds of contract work or freelancing.

The rise in the number of freelancers creates new opportunities but also undermines traditional models of work:

- Workers should familiarize themselves with contract law fundamentals.

- Employers should adapt to the hybrid workforce model of staff and freelancers.

- Governments should revise laws to include gig-economy jobs.

Essentially, this change has been made possible by technology that has led to the rise of such applications as Leadgamp that assist organizations to evaluate the performance of their recruitment campaigns and referral systems, ultimately strengthening their workforce.

Legal Landscape of Contract Work

The legal obligations surrounding contract work differ across borders. However, a few universal points apply:

- Written contracts are always safer than verbal ones.

- Workers must be correctly classified (employee vs. independent contractor).

- Tax responsibilities are typically shifted to the contractor in freelance arrangements.

- Courts enforce clear contracts but rarely interpret vague terms in favor of either side.

With the awareness of these legal factors, employees and employers will prevent disputes accordingly.

Common Pitfalls to Avoid

Despite the existence of clearly defined agreements, conflicts and misunderstandings happen. Most common traps look like this:

- Unclear job description: Not specifying deliverables precisely leads to “scope creep.”

- Delayed or incomplete payments: Employers’ delays in paying invoices may inhibit trust among workers.

- Misclassification of employment: A contractor is treated as a full-time employee without the benefits.

- Dispute clauses being ignored: Parties forget agreed arbitration or resolution mechanisms.

Best Practices for Successful Contract Work

To be fruitful in contract employment, obtain these best practices into consideration:

For Workers:

- Review each clause in detail and if in doubt consult a legal expert.

- Keep accurate records of hours of work, services rendered, and paperwork.

- Utilize professional invoicing software for prompt payments.

For Employers:

- Give out a clear document that contains no hidden clauses.

- Make payments in a timely manner and uphold the contractor’s independence.

- Build long-term relationships with trustworthy freelancers.

Wrap-Up

Making a learning contract is not just about the signature on a paper. It is a necessity, especially the trade rights, responsibilities, and duties that are there both for the employers and the employees or the freelancers and the independent contractors.

The flexibility of the labor market has gained popularity thanks to successful communication, the clear contracts, and legal knowledge. Even if you are designing your very first freelance contract or bargaining for a complex corporate service contract, you should be well-versed in the fundamental characteristics of equality, compliance, and partnership.

As freelance and contract engagement rises, companies and workers have to work hard to achieve the right balance of rights and obligations.

Leave a Reply